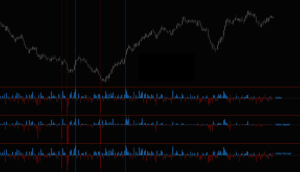

Orderflow Delta Overview

Delta is a measure of aggressive buyers and sellers in the auction. It represents the difference in volume transacted at Ask Price and volume transacted at Bid Price. Cumulative Delta is the net difference between volume transacted at Ask Price and volume transacted at Bid Price over a period of time.

Orderflow Delta Indicator Highlights:

This indicator is included in our Orderflow Package.

- Multiple ways to represent Delta: raw value, speed and percentage of total transacted volume

- Multiple ways to represent Bid and Ask volume: raw values, speed and percentage of total transacted volume

- Cumulative Delta for Regular Trading Hours (RTH) and Extended Trading Hours (ETH) sessions

- Swing based Delta (also referred to as Leg to Leg)

- Delta Stochastics (to help identify divergences)

- Ability to highlight Delta, Delta Speed, Delta Percent that exceed a configurable threshold

- Enhanced Plots menus allow customization of every aspect of plots including plot names and ability to conveniently turn plots on/off individually

- Does not require NinjaTrader’s Lifetime license

- Does not require Tick Replay

Information Offered by Orderflow Delta:

- Delta view chart

- Delta Speed (per second)

- Delta as percentage of Total Volume

- Bid & Ask Volume view chart

- Bid & Ask Volume Speed (per second)

- Bid & Ask Volume as percentage of Total Volume

- Cumulative Delta for RTH and ETH sessions view chart

- Swing Delta view chart

- Delta Stochastics view chart