VWAP/TWAP Overview

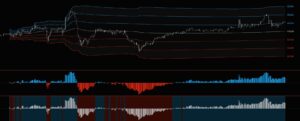

Volume Weighted Average Price (VWAP) calculates the average price of a security over a specific period, factoring in both price and traded volume. This powerful metric is widely used by traders to assess market trends, identify potential entry and exit points, and gauge the overall market sentiment by emphasizing volume as a critical component of price action.

Time Weighted Average Price (TWAP) determines the average price of a security over a defined period, focusing solely on time without accounting for traded volume. This approach is ideal for traders seeking a straightforward benchmark to evaluate price movements evenly across time intervals, making it useful for algorithmic trading or assessing consistent price trends.

VWAP/TWAP Indicator Highlights:

This indicator is included in our Orderflow Package and is also available as a standalone product.

- Multiple methods of calculating VWAP/TWAP are available:

- Regular VWAP:

- Offers many pre-configured reset intervals such as: Swing, RTH or ETH session, Week, Month, Quarter, Year

- Up to 5 customizable Standard Deviation bands

- VWAP Oscillator:

- Offers many pre-configured reset intervals such as: Swing, RTH or ETH session, Week, Month, Quarter, Year

- Difference can be calculated in Points or Percentage

- Anchored VWAP:

- Up to 5 different anchors per indicator instance

- Rolling VWAP:

- Rolling periods in any multiple of days, weeks and months

- Up to 5 customizable Standard Deviation band

- Single Anchored VWAP with up to 5 customizable Standard Deviation bands

- Single Anchored TWAP with up to 5 customizable Standard Deviation bands

- Multiple ways of highlighting when price is above or below VWAP by:

- Changing plot color

- Changing price bar color

- Highlighting chart background

- Automatic Accuracy vs. Performance Optimization delivers highly accurate intraday calculations while boosting speed for higher timeframes (Week, Month, Quarter, Year).

- Enhanced Plots menus allow customization of every aspect of plots including plot names and ability to conveniently turn plots on/off individually

- Does not require NinjaTrader’s Lifetime license

- Does not require Tick Replay